|

|

CA Min Wage Increase Signed Into Law

Lakshmi.Saevel Lakshmi.Saevel

サーバ: Lakshmi

Game: FFXI

Posts: 2228

By Lakshmi.Saevel 2013-10-02 05:35:01

Quote: I can assure you minium wage in Watts, CA with assisted living will cut it but it OBVIOUSLY won't in let's say La Jolla, CA

Something they forgot to mention, is that tax credits and deductions make your effective federal income tax somewhere around 0% when your under the poverty line. People making that little money really shouldn't be paying tax's anyway, they have nearly no disposable income as it is.

[+]

Bahamut.Kara Bahamut.Kara

サーバ: Bahamut

Game: FFXI

Posts: 3544

By Bahamut.Kara 2013-10-02 05:38:49

Quote: I can assure you minium wage in Watts, CA with assisted living will cut it but it OBVIOUSLY won't in let's say La Jolla, CA

Something they forgot to mention, is that tax credits and deductions make your effective federal income tax somewhere around 0% when your under the poverty line. People making that little money really shouldn't be paying tax's anyway, they have nearly no disposable income as it is.

Minimum wage is currently not below the poverty line.

Edit: for a single person with up to one dependent in CA

http://aspe.hhs.gov/poverty/13poverty.cfm

Caitsith.Zahrah Caitsith.Zahrah

By Caitsith.Zahrah 2013-10-02 08:47:47

Some interesting tid-bits to go through in both threads!

Although still on the fence about the minimum-wage hike and what effects may come nationally (if at all), didn't Brown's changing of the guard and austerity measures like raising taxes while cutting budgetary fat leave CA with a budgetary surplus within the past year? If they continue on this course, wouldn't they possibly be able to sustain this extended hand?

EDIT: Oh my! WWII was brought up in a thread and it hasn't taken the death spiral yet!?!

/shocked

I think we've crossed a new threshold!

Bahamut.Kara Bahamut.Kara

サーバ: Bahamut

Game: FFXI

Posts: 3544

By Bahamut.Kara 2013-10-02 09:15:07

@Bacon

Most of the sites are currently unavailable to look at census information, USDA, transportation, etc.

However, when those sites are available again the data is available for city cost of living comparision in cities (you could also do it now if you want to pay money through AACRA, but that is really silly)

http://www.coli.org/

If you look at "Click to Compare the Cost of Living Index in Your Cities of Choice" --> "Sample Comparision report"

You can see how the reports are set-up.

Data from COLI, but it is missing the national average numbers.

http://www.infoplease.com/business/economy/cost-living-index-us-cities.html

[+]

By Zerowone 2013-10-02 09:17:26

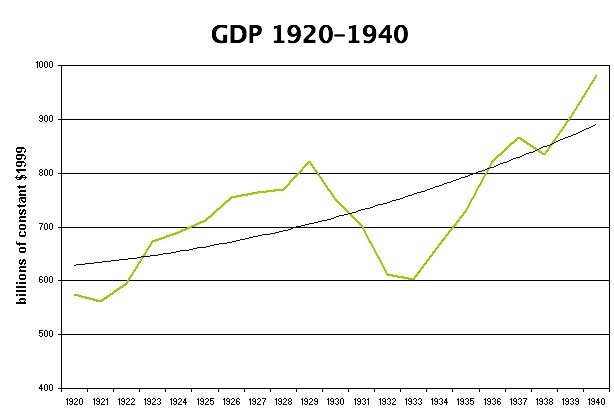

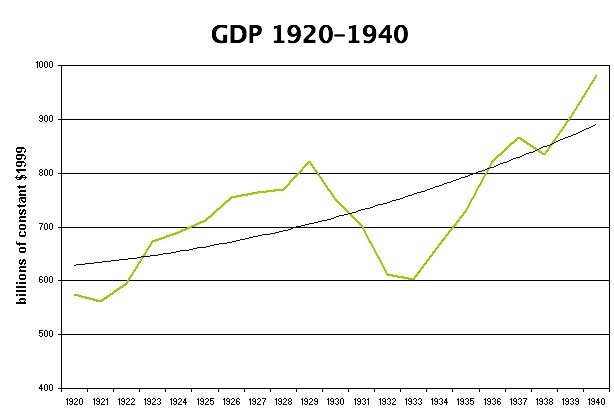

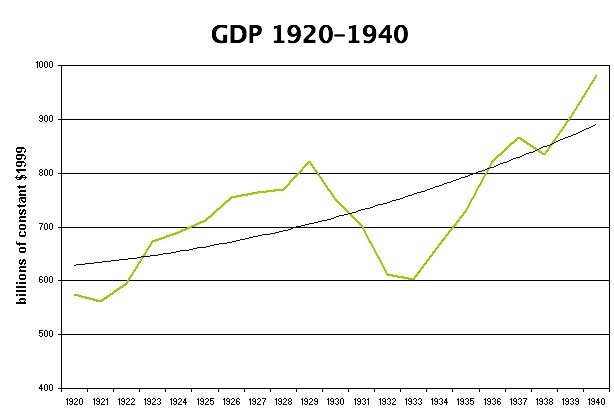

Here's my chart:

Notice the peak in the middle of 1928, now look at the drop weeeeeeeeeeeeeeee bottoms out at just before 1933. Notice that the peak of 1928 is right around 825 Billion. Now look at this period of time before the war. Look at that we surpass the peak of 1928 in 1935. There is a bit of a dip but the GDP doesn't go below the mid 1928 peak. Then this war starts and it just skyrockets..... Here's the other thing. New Deal policies are still in effect to this very day.

Though you may presume a person doesn't have an economic background, your persumption is wrong. Economic policies take a time before one sees the fruit of their labor correct. So then how can one conflate the maturity of programs at the same time a global war occurs? In that very statement you have outted yourself and your argument. You simply just want to be right even though you have been wrong. If FDR's New Deal policies weren't so effective; then why did Eisenhower (a Republican president) expand them? Why would there still be New Deal policies in effect today? Which in it's very essence means that all of America's prosperity and even it's failings (repealng of Glass-Steagall for instance) are tied to the New Deal in one way or another.

Check and mate.

Wait, your defense is nominal GDP? How is nominal GDP better than real GDP? Oh wait, it isn't.

We know that the New Deal isn't effective, but it was necessary at the time that we needed it. I'm pretty sure that if we had the knowledge of today as of for that time, the New Deal wouldn't have even been discussed, as there has been better and more effective ways to handle recessions.

Quote: Ps: To the noble observer: As much of a derailment as this may appear as off topic diatribe and mental masturbation. Minimum wage is a New Deal policy.

Yes, it is. It has also been proven to not only be a complete waste of air, but also counterproductive to society as a whole.

Quote: Post Edit:

Oh and about that "reading comprehension" comment:

My argument wasn't that FDR was "cleaning" other president's messes , it was that FDR wasn't the "savior" that you made him out to be.

No, you weren't I was arguing that he did clean up the mess and that your attempt to dimnish the effect of his policies was wrong. Nice try though. Also like how you quoted line for line like it was 2001. Way to out your reading comprehension or lack thereof in the first clause of that sentence.

Remember it's 2013 and you're in a thread regarding "minium wage" a product of the Fair Labor Act of 1938 of the New Deal II enacted by Franklin Delano Roosevelt and you're the one saying his policies haven't had an impact. What, you referenced a popularity poll and even stated that Roosevelt cleaned up his predecessors messes based off that same popularity poll.

I stated that WWII was Roosevelt's saving grace, without that war he would have been demonized like Hoover was. Here, you can even see the post yourself

Your "sources" involve a popularity poll and a graph that shows the wrong information you are trying to convey. How is that helping your argument at all?

Also, spell-check is your friend.

Grammar, syntax and developing a winning argument apparently aren't your friends. Since you like to use this line to cut people down; here's how bad your comprehension is. The use of the Rasmussen poll was an intentional troll tactic towards Mr. wannabe Sam Elliot who so loves to use Rasmussen polls to validate his points. The beauty of the poll was that it established from a conservative point of view that FDR was more popular than Harding, Coolidge, and Hoover combined. Then the subsequent posts extrapolated on the "why" FDR was more popular; but you still seem stuck on the poll post as if it's your excalibur to the argument. You jumped in as his white knight and said and I'm paraphrasing because you're a bag of hot air and my recapitulation is much more fun to read:

"NO!!! It's because of WWII not the relative immediate and long term effects of the New Deal programs which returned nominal GDP to levels above the 1928 peak and subsequent 1929 crash by 1935 and still have had a long lasting effect to this very day!! It' was all purely WWII!!! Ignore that we're in a thread discussing minimum wage in 2013 which is a policy enacted in 1938, because I'm Kingnobody and nobody is right but me!!! Cause minimum wage is a detriment to society even!!!" - Kingnobody ~ FFXI AH » Forum » Everything Else » Politics and Religion » CA Min Wage Increase Signed Into Law 2013

That's basically what've you said. What I would like to point out to you Mr. Pseudo-economist, is that you blantantly ignored this following paragraph. I know its because you didn't understand it; since it was intentionally put out as bait to offend any real economist or even a hobbyist CPA which you pretend to be.

Why don't you go FV=PMT(1+i)((1+i)^N - 1)/i instead of pretending that people don't have experience with things like AD = GDP = C(Y - T) + I(r) + G + NX or ∆Y/∆G= 1/1-m or ∆Y/∆T= -m/1-m or BBM= ∆Y /∆G + ∆Y/∆T.

Here's a key for you to decipher:

FV=PMT(1+i)((1+i)^N - 1)/i is a future value fomula more commonly known as compound annuity.

AD = GDP = C(Y - T) + I(r) + G + NX = Composition of GDP

∆Y/∆G= 1/1-m = Relationship between Government spending and Real GDP.

∆Y/∆T= -m/1-m = Relationship between taxes and real GDP.

BBM= ∆Y /∆G + ∆Y/∆T = Changing Government expenditures and Taxes to close recessionary gaps.

It's been fun kid but nobody agrees with you and that might be the reason why you have a compelling need to keep posting.

PS: How's my spelling? k thx bai* <3 01

[+]

Ragnarok.Nausi Ragnarok.Nausi

サーバ: Ragnarok

Game: FFXI

Posts: 6709

By Ragnarok.Nausi 2013-10-02 09:27:56

Yes, well wiki is wrong. Unemployment insurance is not sponsored by the state. Each person has to pay for their own. (reference 21, the webpage does not exist)

https://www.workindenmark.dk/en/Find_information/Information_for_job_seekers/Working_in_Denmark/Unemployment_insurance

The second sentence is not referenced and I have no idea where they got that from.

As to your other post you dragged NATO into something that is silly. NATO is not the only military organization Denmark belongs (UN, EU) to and they are staunch allies of the US. Constantly backing US intervention and providing resources (not just money). Which is why I said you are talking out of your ***. You picked a statistic out of thin air and tied that with poverty levels.

I'm not saying people are guaranteed a living wage, I'm asking for you to come up with a solution for people who work full time and cannot live on those minimum wages alone. So far you offered no solution to that.

The federal government is not the only one that subsidizes companies. Many states offer subsidizes (or incentives) for moving to their state....thus subsidizing those companies. They also reduce or eliminate state taxes for those companies.

Of course economic growth helps with poverty, depending on where that growth is. That is like saying rain will help a drought. It doesn't offer anything.

Ok, so we'll just have to agree to disagree. If the US didn't have a bloated military budget which composed almost half the worlds spending on defense, I would argue that that money is still spent appropriately (as if that would ever happen) by the government would smooth out many grooves in poverty. All I need to do is point to Denmark and say look at the taxation, look at the lack of military spending, and instead look at the assistance (welfare state) provided to it's citizens. You can't have both, unless you're a member of NATO and not the US.

Ultra right wing rag

Some other site I found

Now can we come back to topic?

------

As for a solution for the unfortunate among us who can only scrap together minimum wage:

Economic growth! A growing economy requires workers, when the need for workers outstrips the supply of them, they become more valuable. This is economics 101 (supply and demand). The last 5 years of tepid, barely enough to keep up with the population increase, part time jobs because of obamacare, just aren't gonna cut it.

Lower taxes! In order to grow, private businesses (not the government) need more capital and more promising returns on the money they make. If my idea for starting my own company where I need 10 skilled workers is not feasible because my tax bill doesn't leave enough left to cover my overhead and still be competitive, something is wrong.

Constrict the welfare state! If life is easy without work IE if you can eat, sleep, f*ck, play on the internet, and watch your flat screen cable without working, then you are too comfortable. Whatever mechanisms are in place to facilitate that level of laziness needs to be deconstructed. No one minds lending a helping hand, but subsidizing a wasted life is not nor should it be anyone's business.

By Zerowone 2013-10-02 09:31:09

They haven't mentioned adjusting Unemployment Insurance rates which means you fall into higher payout bracket if the unfortunate were to occur. If I recall and its been some time since I've worked in CA. 08' being my last year there and was making about 18-26/hr which put me at the payout cap of 450/week. However, 10/hr at roughly 40hrs to 60hrs/week would be about 310 a week or 1240 dollars in unemployment insurance a month. Which ironically is better money then what some people are making in other parts of the country.

[+]

サーバ: Asura

Game: FFXI

Posts: 34187

By Asura.Kingnobody 2013-10-02 10:48:34

Here's my chart:

Notice the peak in the middle of 1928, now look at the drop weeeeeeeeeeeeeeee bottoms out at just before 1933. Notice that the peak of 1928 is right around 825 Billion. Now look at this period of time before the war. Look at that we surpass the peak of 1928 in 1935. There is a bit of a dip but the GDP doesn't go below the mid 1928 peak. Then this war starts and it just skyrockets..... Here's the other thing. New Deal policies are still in effect to this very day.

Though you may presume a person doesn't have an economic background, your persumption is wrong. Economic policies take a time before one sees the fruit of their labor correct. So then how can one conflate the maturity of programs at the same time a global war occurs? In that very statement you have outted yourself and your argument. You simply just want to be right even though you have been wrong. If FDR's New Deal policies weren't so effective; then why did Eisenhower (a Republican president) expand them? Why would there still be New Deal policies in effect today? Which in it's very essence means that all of America's prosperity and even it's failings (repealng of Glass-Steagall for instance) are tied to the New Deal in one way or another.

Check and mate.

Wait, your defense is nominal GDP? How is nominal GDP better than real GDP? Oh wait, it isn't.

We know that the New Deal isn't effective, but it was necessary at the time that we needed it. I'm pretty sure that if we had the knowledge of today as of for that time, the New Deal wouldn't have even been discussed, as there has been better and more effective ways to handle recessions.

Quote: Ps: To the noble observer: As much of a derailment as this may appear as off topic diatribe and mental masturbation. Minimum wage is a New Deal policy.

Yes, it is. It has also been proven to not only be a complete waste of air, but also counterproductive to society as a whole.

Quote: Post Edit:

Oh and about that "reading comprehension" comment:

My argument wasn't that FDR was "cleaning" other president's messes , it was that FDR wasn't the "savior" that you made him out to be.

No, you weren't I was arguing that he did clean up the mess and that your attempt to dimnish the effect of his policies was wrong. Nice try though. Also like how you quoted line for line like it was 2001. Way to out your reading comprehension or lack thereof in the first clause of that sentence.

Remember it's 2013 and you're in a thread regarding "minium wage" a product of the Fair Labor Act of 1938 of the New Deal II enacted by Franklin Delano Roosevelt and you're the one saying his policies haven't had an impact. What, you referenced a popularity poll and even stated that Roosevelt cleaned up his predecessors messes based off that same popularity poll.

I stated that WWII was Roosevelt's saving grace, without that war he would have been demonized like Hoover was. Here, you can even see the post yourself

Your "sources" involve a popularity poll and a graph that shows the wrong information you are trying to convey. How is that helping your argument at all?

Also, spell-check is your friend.

Grammar, syntax and developing a winning argument apparently aren't your friends. Since you like to use this line to cut people down; here's how bad your comprehension is. The use of the Rasmussen poll was an intentional troll tactic towards Mr. wannabe Sam Elliot who so loves to use Rasmussen polls to validate his points. The beauty of the poll was that it established from a conservative point of view that FDR was more popular than Harding, Coolidge, and Hoover combined. Then the subsequent posts extrapolated on the "why" FDR was more popular; but you still seem stuck on the poll post as if it's your excalibur to the argument. You jumped in as his white knight and said and I'm paraphrasing because you're a bag of hot air and my recapitulation is much more fun to read:

"NO!!! It's because of WWII not the relative immediate and long term effects of the New Deal programs which returned nominal GDP to levels above the 1928 peak and subsequent 1929 crash by 1935 and still have had a long lasting effect to this very day!! It' was all purely WWII!!! Ignore that we're in a thread discussing minimum wage in 2013 which is a policy enacted in 1938, because I'm Kingnobody and nobody is right but me!!! Cause minimum wage is a detriment to society even!!!" - Kingnobody ~ FFXI AH » Forum » Everything Else » Politics and Religion » CA Min Wage Increase Signed Into Law 2013

That's basically what've you said. What I would like to point out to you Mr. Pseudo-economist, is that you blantantly ignored this following paragraph. I know its because you didn't understand it; since it was intentionally put out as bait to offend any real economist or even a hobbyist CPA which you pretend to be.

Why don't you go FV=PMT(1+i)((1+i)^N - 1)/i instead of pretending that people don't have experience with things like AD = GDP = C(Y - T) + I(r) + G + NX or ∆Y/∆G= 1/1-m or ∆Y/∆T= -m/1-m or BBM= ∆Y /∆G + ∆Y/∆T.

Here's a key for you to decipher:

FV=PMT(1+i)((1+i)^N - 1)/i is a future value fomula more commonly known as compound annuity.

AD = GDP = C(Y - T) + I(r) + G + NX = Composition of GDP

∆Y/∆G= 1/1-m = Relationship between Government spending and Real GDP.

∆Y/∆T= -m/1-m = Relationship between taxes and real GDP.

BBM= ∆Y /∆G + ∆Y/∆T = Changing Government expenditures and Taxes to close recessionary gaps.

It's been fun kid but nobody agrees with you and that might the reason why you have a compelling need to keep posting.

PS: How's my spelling? k thx bai* <3 01

So, wait, did you just admit that you are just trolling everyone?

サーバ: Phoenix

Game: FFXI

Posts: 3686

By Phoenix.Amandarius 2013-10-02 12:11:51

Quote: I can assure you minium wage in Watts, CA with assisted living will cut it but it OBVIOUSLY won't in let's say La Jolla, CA

Something they forgot to mention, is that tax credits and deductions make your effective federal income tax somewhere around 0% when your under the poverty line. People making that little money really shouldn't be paying tax's anyway, they have nearly no disposable income as it is.

I think everyone should have skin in the game; even those of low income still need to pay tax. It is too easy to not give a crap about what the government does with our money if you don't pay into it. It becomes especially dangerous to democracy when the number of people not paying income tax grows to a large percentage. It leads to extremely irresponsible government spending.

サーバ: Valefor

Game: FFXI

Posts: 1837

By Valefor.Applebottoms 2013-10-02 12:30:51

NFL doesn't pay taxes, it's a "non-profit organization"

With instances like these, it makes you wonder who else is considered "non-profit".

[+]

Cerberus.Pleebo Cerberus.Pleebo

サーバ: Cerberus

Game: FFXI

Posts: 9720

By Cerberus.Pleebo 2013-10-02 12:32:49

Phoenix.Amandarius said: »Quote: I can assure you minium wage in Watts, CA with assisted living will cut it but it OBVIOUSLY won't in let's say La Jolla, CA

Something they forgot to mention, is that tax credits and deductions make your effective federal income tax somewhere around 0% when your under the poverty line. People making that little money really shouldn't be paying tax's anyway, they have nearly no disposable income as it is.

I think everyone should have skin in the game; even those of low income still need to pay tax. It is too easy to not give a crap about what the government does with our money if you don't pay into it. It becomes especially dangerous to democracy when the number of people not paying income tax grows to a large percentage. It leads to extremely irresponsible government spending. They do.

[+]

サーバ: Valefor

Game: FFXI

Posts: 1837

By Valefor.Applebottoms 2013-10-02 12:45:43

Phoenix.Amandarius said: »Quote: I can assure you minium wage in Watts, CA with assisted living will cut it but it OBVIOUSLY won't in let's say La Jolla, CA

Something they forgot to mention, is that tax credits and deductions make your effective federal income tax somewhere around 0% when your under the poverty line. People making that little money really shouldn't be paying tax's anyway, they have nearly no disposable income as it is.

I think everyone should have skin in the game; even those of low income still need to pay tax. It is too easy to not give a crap about what the government does with our money if you don't pay into it. It becomes especially dangerous to democracy when the number of people not paying income tax grows to a large percentage. It leads to extremely irresponsible government spending. They do. Most do. You still have instances of people getting paid "under the table", but a lot of those jobs are decreasing just because of the thought of "getting caught". That and most places that do that go out of business for other reasons.

Trust me, every paycheck I get I always look at it and wonder "how much in taxes did they take this month?" As I'm sure with several others.

But hey, I'm supporting the NFL to make more money, so it's ok. lol.

[+]

Caitsith.Zahrah Caitsith.Zahrah

By Caitsith.Zahrah 2013-10-02 12:52:19

Why don't you go FV=PMT(1+i)((1+i)^N - 1)/i instead of pretending that people don't have experience with things like AD = GDP = C(Y - T) + I(r) + G + NX or ∆Y/∆G= 1/1-m or ∆Y/∆T= -m/1-m or BBM= ∆Y /∆G + ∆Y/∆T.

Here's a key for you to decipher:

FV=PMT(1+i)((1+i)^N - 1)/i is a future value fomula more commonly known as compound annuity.

AD = GDP = C(Y - T) + I(r) + G + NX = Composition of GDP

∆Y/∆G= 1/1-m = Relationship between Government spending and Real GDP.

∆Y/∆T= -m/1-m = Relationship between taxes and real GDP.

BBM= ∆Y /∆G + ∆Y/∆T = Changing Government expenditures and Taxes to close recessionary gaps.

It's been fun kid but nobody agrees with you and that might be the reason why you have a compelling need to keep posting.

PS: How's my spelling? k thx bai* <3 01

OMG! LOL! I think I need to give up on this. :/

Did anyone else work it out according to the graphs both Zero and KN gave?

/hides in a hole

I have to say though, between Jetaku's Intro to Binary and this, AH does provide a few fun, little lessons.

EDIT: TY, Zero. You've contributed a more than KN has for the accounting laymen.

[+]

Siren.Flavin Siren.Flavin

サーバ: Siren

Game: FFXI

Posts: 4155

By Siren.Flavin 2013-10-02 13:08:12

So what if everyone becomes educated and no one is willing to work for minimum wage anymore?!?! fast food industries would crumble! department stores would fade away! People would riot in the streets as the dollar menu disappeared forever! Madness!

サーバ: Phoenix

Game: FFXI

Posts: 3686

By Phoenix.Amandarius 2013-10-02 14:06:52

Phoenix.Amandarius said: »Quote: I can assure you minium wage in Watts, CA with assisted living will cut it but it OBVIOUSLY won't in let's say La Jolla, CA

Something they forgot to mention, is that tax credits and deductions make your effective federal income tax somewhere around 0% when your under the poverty line. People making that little money really shouldn't be paying tax's anyway, they have nearly no disposable income as it is.

I think everyone should have skin in the game; even those of low income still need to pay tax. It is too easy to not give a crap about what the government does with our money if you don't pay into it. It becomes especially dangerous to democracy when the number of people not paying income tax grows to a large percentage. It leads to extremely irresponsible government spending. They do.

No, not the federal income tax after tax credits and refunds.

Siren.Flavin Siren.Flavin

サーバ: Siren

Game: FFXI

Posts: 4155

By Siren.Flavin 2013-10-02 14:12:13

See now you're getting specific! lol... It's ok to use whatever means necassary to pay less on your taxes and you should find every loophole! I mean unless you end up getting everything back because well that's just *** up...

サーバ: Asura

Game: FFXI

Posts: 34187

By Asura.Kingnobody 2013-10-02 14:14:19

See now you're getting specific! lol... It's ok to use whatever means necassary to pay less on your taxes and you should find every loophole! I mean unless you end up getting everything back because well that's just *** up... Isn't that the liberal mantra against the rich?

"They use all of these tax loopholes and don't pay their 'fair' share of taxes!!!"

サーバ: Phoenix

Game: FFXI

Posts: 3686

By Phoenix.Amandarius 2013-10-02 14:22:26

See now you're getting specific! lol... It's ok to use whatever means necassary to pay less on your taxes and you should find every loophole! I mean unless you end up getting everything back because well that's just *** up...

I'm sorry how many times did I have to say income tax in my post before you understood what I was talking about?

Siren.Flavin Siren.Flavin

サーバ: Siren

Game: FFXI

Posts: 4155

By Siren.Flavin 2013-10-02 14:22:27

See now you're getting specific! lol... It's ok to use whatever means necassary to pay less on your taxes and you should find every loophole! I mean unless you end up getting everything back because well that's just *** up... Isn't that the liberal mantra against the rich? "They use all of these tax loopholes and don't pay their 'fair' share of taxes!!!" idk what the liberal mantra is I don't subscribe to the newsletter...

Personally I think people on the lower part of the income spectrum just assume the rich can all just afford it and they just want them to pay for it lol... I don't agree with them at all but it's easy to understand why they may think that way...

I see ***all the time where juries award ridiculous amounts of cash to people that clearly deserve to be in jail rather than receive a mountain of cash mainly because they feel bad for the person and figure the company can afford it...

Getting back to the original point... if it's ok for one to do it why do you complain when others take advantage? I mean it just looks like the same thing is being done by all and each side complaining because they feel like the other isn't paying enough in lol... or at least keeping enough in...

Siren.Flavin Siren.Flavin

サーバ: Siren

Game: FFXI

Posts: 4155

By Siren.Flavin 2013-10-02 14:22:54

Phoenix.Amandarius said: »See now you're getting specific! lol... It's ok to use whatever means necassary to pay less on your taxes and you should find every loophole! I mean unless you end up getting everything back because well that's just *** up... I'm sorry how many times did I have to say income tax in my post before you understood what I was talking about? I was being facetious... /sigh

In any case... they still do pay taxes... they just get the money back...

VIP

サーバ: Odin

Game: FFXI

Posts: 9534

By Odin.Jassik 2013-10-02 14:25:18

Because your average minimum wage worker has bank accounts in the Cayman Islands...

[+]

Leviathan.Andret Leviathan.Andret

サーバ: Leviathan

Game: FFXI

Posts: 1071

By Leviathan.Andret 2013-10-02 14:39:26

If i was rich then I would go somewhere that I can pay as little tax as possible and move my income there. If I can't then I'll hire someone to do the tax for me and pay as little as possible... like investing in an international company.

There is a reason why the middle class is the one paying the most taxes. It's not because of tax laws but it's because they can't enjoy the benefit of exploiting tax loopholes or just simply off-shore their tax-able income/assets.

For the poor... well there is one simple rule in getting tax "Do not tax the poor". Or possibly tax them as few as possible as you don't get much from poor people and you hurt the economy and probably costs more in the long run as living standards, security, social problems...ect worsen.

In general, the best tax practices would need to target the rich. It's not a moral problem, it's a practical problem. In ancient times, salt and luxuries were the main target for taxation as only people who were rich could afford those. Nowadays, people tax stuff based on average price. Luxury cars, land, houses...etc would have a high taxes while basic necessities would get certain reductions. The principles would be the same but it gets progressively complex and difficult when you have the international market.

[+]

サーバ: Asura

Game: FFXI

Posts: 34187

By Asura.Kingnobody 2013-10-02 14:50:02

See now you're getting specific! lol... It's ok to use whatever means necassary to pay less on your taxes and you should find every loophole! I mean unless you end up getting everything back because well that's just *** up... Isn't that the liberal mantra against the rich? "They use all of these tax loopholes and don't pay their 'fair' share of taxes!!!" idk what the liberal mantra is I don't subscribe to the newsletter...

Personally I think people on the lower part of the income spectrum just assume the rich can all just afford it and they just want them to pay for it lol... I don't agree with them at all but it's easy to understand why they may think that way...

I see ***all the time where juries award ridiculous amounts of cash to people that clearly deserve to be in jail rather than receive a mountain of cash mainly because they feel bad for the person and figure the company can afford it...

Getting back to the original point... if it's ok for one to do it why do you complain when others take advantage? I mean it just looks like the same thing is being done by all and each side complaining because they feel like the other isn't paying enough in lol... or at least keeping enough in... You would have to ask Pleebo, Jassik, and Jet for the newsletter, but they (along with others) pretty much chant the same thing over and over again.

I have no objections for equal treatment of the tax code. But lets face it, there is no equal treatment at all. The rich has less deduction opportunities than the poor.

サーバ: Asura

Game: FFXI

Posts: 34187

By Asura.Kingnobody 2013-10-02 14:52:42

There is a reason why the middle class is the one paying the most taxes. It's not because of tax laws but it's because they can't enjoy the benefit of exploiting tax loopholes or just simply off-shore their tax-able income/assets.

How is taking advantage of the tax rules available for everyone exploiting?

Plus, you can't move taxable income off-shores if they were earned in the US. That is one of the biggest myths ever told...

Cerberus.Pleebo Cerberus.Pleebo

サーバ: Cerberus

Game: FFXI

Posts: 9720

By Cerberus.Pleebo 2013-10-02 14:58:10

Stop talking about me. I'm not part of your conversation, lol.

Phoenix.Amandarius said: »Phoenix.Amandarius said: »Quote: I can assure you minium wage in Watts, CA with assisted living will cut it but it OBVIOUSLY won't in let's say La Jolla, CA

Something they forgot to mention, is that tax credits and deductions make your effective federal income tax somewhere around 0% when your under the poverty line. People making that little money really shouldn't be paying tax's anyway, they have nearly no disposable income as it is.

I think everyone should have skin in the game; even those of low income still need to pay tax. It is too easy to not give a crap about what the government does with our money if you don't pay into it. It becomes especially dangerous to democracy when the number of people not paying income tax grows to a large percentage. It leads to extremely irresponsible government spending. They do.

No, not the federal income tax after tax credits and refunds. Federal taxes are not the only "game" to have skin in.

Saying they pay no net taxes is admitting that they do indeed have a financial liability in the taxing process at some point (i.e. skin in the game).

I hate the phrase "skin in the game" ._.

[+]

VIP

サーバ: Odin

Game: FFXI

Posts: 9534

By Odin.Jassik 2013-10-02 15:16:38

You would have to ask Pleebo, Jassik, and Jet for the newsletter, but they (along with others) pretty much chant the same thing over and over again.

In the radical moronic right, when EVERYONE disagrees with you, it's a conspiracy.

PS. real conservatives hate you clowns more than liberals do.

[+]

Siren.Flavin Siren.Flavin

サーバ: Siren

Game: FFXI

Posts: 4155

By Siren.Flavin 2013-10-02 15:31:14

See now you're getting specific! lol... It's ok to use whatever means necassary to pay less on your taxes and you should find every loophole! I mean unless you end up getting everything back because well that's just *** up... Isn't that the liberal mantra against the rich? "They use all of these tax loopholes and don't pay their 'fair' share of taxes!!!" idk what the liberal mantra is I don't subscribe to the newsletter... Personally I think people on the lower part of the income spectrum just assume the rich can all just afford it and they just want them to pay for it lol... I don't agree with them at all but it's easy to understand why they may think that way... I see ***all the time where juries award ridiculous amounts of cash to people that clearly deserve to be in jail rather than receive a mountain of cash mainly because they feel bad for the person and figure the company can afford it... Getting back to the original point... if it's ok for one to do it why do you complain when others take advantage? I mean it just looks like the same thing is being done by all and each side complaining because they feel like the other isn't paying enough in lol... or at least keeping enough in... You would have to ask Pleebo, Jassik, and Jet for the newsletter, but they (along with others) pretty much chant the same thing over and over again. I have no objections for equal treatment of the tax code. But lets face it, there is no equal treatment at all. The rich has less deduction opportunities than the poor. And you call yourself an accountant!

I don't think that's necassarily true either... not to mention that the rich usually have more opportunites to move their money around and such... it's usually the middle class that gets screwed...

Siren.Flavin Siren.Flavin

サーバ: Siren

Game: FFXI

Posts: 4155

By Siren.Flavin 2013-10-02 15:32:43

There is a reason why the middle class is the one paying the most taxes. It's not because of tax laws but it's because they can't enjoy the benefit of exploiting tax loopholes or just simply off-shore their tax-able income/assets. How is taking advantage of the tax rules available for everyone exploiting? Plus, you can't move taxable income off-shores if they were earned in the US. That is one of the biggest myths ever told... and yet people find ways to do it lol... wasn't there some big stink recently over in swiss cheeseland regarding this stuff?

By Zerowone 2013-10-02 15:38:39

If we're talking about the rich and multinational corporations the proper term is "Capital gains".

If we're talking about everyone else the term is "Income Tax".

If we're talking about offshore accounts we're talking about "tax havens".

If we're talking about tax haven's we're talking about "subsidiaries of multinational corporations siphoning royalties from the parent company".

If we're talking about the rich and multinationals getting tax breaks we're talking about "corporate welfare".

If we're talking about the rich and income taxes then we're just talking out our ***.

If we're complaining about the poor getting 100% tax returns because they don't make enough to match the cost of living and the said poor being smart enough to figure out how to file a "tax return" i.e a return on the taxes already taken out their paycheck for the year. Then we're just a bunch of hater *** who can't stand a person catching a break.

Who ever said the rich has less deduction possibilities than the poor is a liar. See capital gains tax, mortgage interest, charitable deduction percentages vs income tax rates.

サーバ: Asura

Game: FFXI

Posts: 34187

By Asura.Kingnobody 2013-10-02 15:44:07

And you call yourself an accountant!

I don't think that's necassarily true either... not to mention that the rich usually have more opportunites to move their money around and such... it's usually the middle class that gets screwed... Most of the tax credits/deductions are phased out when you hit a certain tax threshold.

Also, thanks to the Pease limitation, Schedule A will be limited when you hit a certain threshold ($300k income for 2013).

And yet, there are no lower limit thresholds for the same credits...meaning anyone and everyone can get the tax credit if you hit the other criteria....

So, yeah, the rich get less "loopholes" than the poor.

Quote: California Gov. Jerry Brown (D) on Wednesday signed a bill approving a $2 minimum wage increase to be rolled out over the next three years. Unless another state passes a larger increase, the bump will make California's minimum wage the highest in the country.

The governor joined legislators, business owners and workers at a signing ceremony in Los Angeles on Wednesday morning, with plans to fly to another ceremony in Oakland that afternoon.

“For millions of California’s hardworking minimum wage employees, a few extra dollars a week can make a huge difference to help them provide for their families,” said state Senate President pro tem Darrell Steinberg in a release. "They deserve a modest boost and after six years, an increase in California’s minimum wage is the right thing to do.”

The minimum wage will go up in two separate $1 increments. The first will bump the rate from $8 to $9 in July 2014, and the second increase, to $10, will come in January 2016. According to the Economic Policy Institute, about 3 million Californians are currently working for minimum wage.

Many low-wage workers across the state hailed the news.

Anthony Goytia, who works the overnight shift at a Walmart store in Duarte, currently lives in a garage with his wife and two children, while a third is on the way.

“If I had a higher wage, we would be able to rent an apartment,” he told The Huffington Post. “[Right now] we’re living in poverty. I have to live check to check.”

He detailed the struggles of living off a low wage, especially with a family. “I want to be able to buy my kids shoes if they need them and not wait for our income tax [return] to do it,” he said. “I want to give my wife money for maternity pants and underwear. She needs bras. It’s just ridiculous.”

Goytia said his family cannot afford Walmart’s health insurance plan and must depend on Medi-Cal, the state's Medicare program, instead. They also frequently receive food stamps.

“I really don’t want to depend on food stamps,” he told HuffPost. “I’m a hardworking person; I want to be a proud, working American that’s not on public assistance."

Maria Cristobal works seasonally in a packinghouse or in the lettuce and chile fields near where she lives with her two children in Fresno.

“Two more dollars would impact me a lot,” she told HuffPost. “I would definitely like to have more money for the house, for food, for rent, utilities.”

But she worries that a minimum wage hike might equal a price hike as well.

“When they raise wages, they raise prices of things," she said. "I think companies will cut back on hiring people, and it’s hard to find work sometimes.”

Brown, however, argued the reverse, saying wages in California have stagnated while consumer prices have continued to rise.

“The minimum wage has not kept pace with rising costs,” the governor said in a release. “This legislation is overdue and will help families that are struggling in this harsh economy.”

But by the time the $10 minimum takes effect, it will probably still be outpaced by inflation. According to the Bureau of Labor Statistics, $10 per hour in 2016 is equivalent to roughly $9.36 in today's dollars.

Assembly Speaker John A. Pérez (D-Los Angeles) also disputed the idea that the minimum wage increase would put a drag on the economy.

“A $10 hour minimum wage boosts earnings by $4,000 a year and will put $2.6 billion dollars back into the hands of workers,” he said. “This is money that will be spent at grocery stores, on school supplies and invested in education, and that ultimately strengthens the recovery and ensures California’s job market continues growing faster than the rest of the nation.”

I know many democrats will disagree with me, but this is supporting "unskilled labor" at best. I understand the concept of helping bring a large chunk of working-class Americans out of the poverty bracket but this doesn't really remedy the problem. It's just a temporary fix for a particular demographic, that ultimately will have severe ramifications on the state economy.

The democrats in CA might have civil rights down, but their views on how to fix the economy is bullsh#t. Earlier this year they decided to invest more money into CA prisons rather than K-12 education...

|

|