|

|

CA Min Wage Increase Signed Into Law

サーバ: Asura

Game: FFXI

Posts: 34187

By Asura.Kingnobody 2013-10-02 22:15:15

by the rate of your postings and nitpicking subject matter and factual inaccurate retorts its worked.

Oh, and before you say that they don't receive a W-2 from receiving stock options, restricted stock, or any other non-monetary forms of compensation, you better understand that they are required to report such transactions on W-2, in box 12, as code V. Which means that that compensation is subject to both social security and Medicare taxes. Which they would have to report on line 60 as "other taxes" and pay them then (which, if not calculated correctly on or before April 15th, and paid on that same day, those taxes are subject to interest and penalties....GASP!).

you can't win this.. ever. I'm surpised whoever pays you to do their taxes hasn't beaten you with a switch yet.

Still batting 1000 son.

When you sell the stock, you nincompoop.

Here, I'll even help you out on this: Middle of page 18, under code V

Quote: Code V—Income from the exercise of nonstatutory

stock option(s). Show the spread (that is, the fair market

value of stock over the exercise price of option(s) granted

to your employee with respect to that stock) from your

employee's (or former employee's) exercise of

nonstatutory stock option(s). Include this amount in boxes

1, 3 (up to the social security wage base), and 5.

This reporting requirement does not apply to the

exercise of a statutory stock option, or the sale or

disposition of stock acquired pursuant to the exercise of a

statutory stock option. For more information about the

taxability of employee stock options, see Pub. 15-B.

I knew you were going to say compensation by stock options and restricted stock, so I beat you to the punch.

The difference between the FMV at the time the options were issued and the option price is compensation to the employee (CEO). The basis of the stock option then becomes the FMV of the stocks when they were issued.

You report any gains or losses when you sell the stock, not when you get PAID in stock.

You still batting 1000? You haven't even hit the ball.

サーバ: Asura

Game: FFXI

Posts: 34187

By Asura.Kingnobody 2013-10-02 22:18:26

If that were true how can I afford the Internet? Or have purchased a house in the last 3 months.

But here it's all explained in the types of compensations portion: Executive Compensations

Now about that last post you did see below.... A) Anyone can say anything on the internet, it doesn't mean that it is true. I'm really Bill Gates and I'm about to buy this website to turn it into another Microsoft subsidiary so I can completely own the internet!

You mean like pretending to be a tax wiz on a video game forum? When really you're just a sad condescending douche that wants people to like him.

couldn't resist. I suppose the only reason the mods haven't locked this thread is because the entertainment level is 11 like my trolling.

So, are you saying that my references to the IRC (Internal Revenue Code, just in case you are wondering) are incorrect or falsified?

I believe I have more than enough proved that I know what I am talking about. You have yet to do anything of the sort, in fact, you have proven that you do not know what in the hell you are talking about.

By Zerowone 2013-10-02 22:48:54

I'm saying you're full of it.

If one does not excercise a non statutory stock option or is in the vesting period, or even transfers to a relative in an arms-length transfer they do not have to report it as income.

Which is why when you excercise your non statutory stock option i.e which is selling it, the form is 1040 schedule D. As you admitted.

You should be ashamed. You've obviously never had stocks either or you wouldn't have corrected me for the sake of your ego.

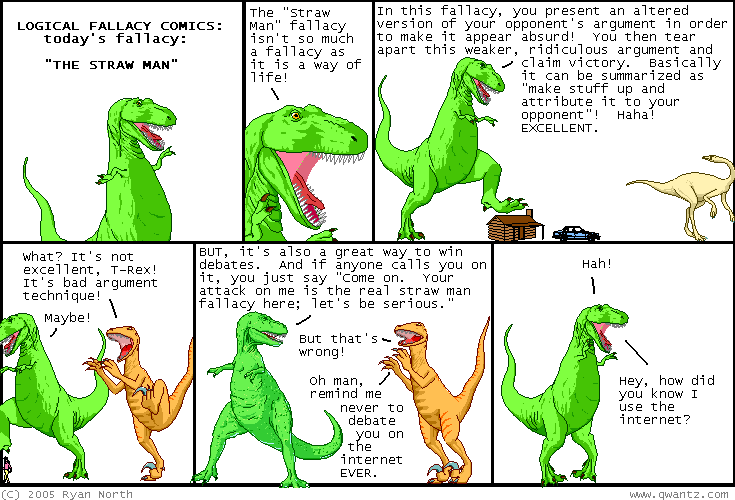

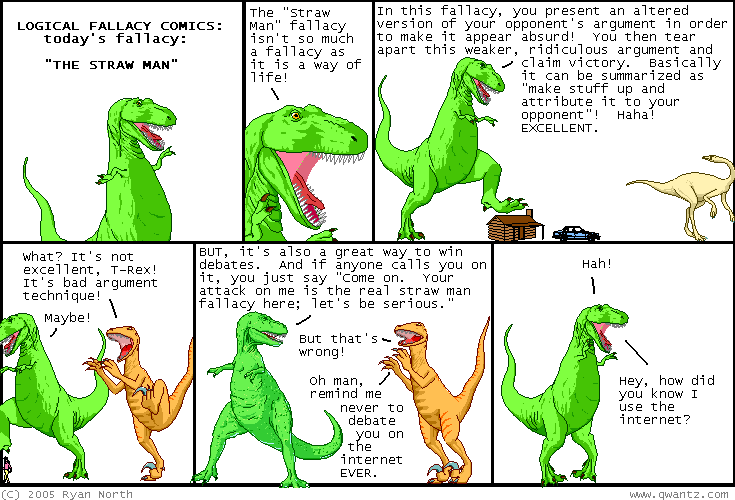

Quote tax code all you want. You still haven't proven you know ***, or understand syntax, or that the New Deal wasn't awesome for America which is where this all started. Changing the topic is called Ignoratio elenchi a tactic you are skilled at but it is still a fallacy.

サーバ: Asura

Game: FFXI

Posts: 34187

By Asura.Kingnobody 2013-10-02 23:01:03

I'm saying you're full of it.

If one does not excercise a non statutory stock option or is in the vesting period, or even transfers to a relative in an arms-length transfer they do not have to report it as income.

Which is why when you excercise your non statutory stock option i.e which is selling it, the form is 1040 schedule D. As you admitted.

You should be ashamed. You've obviously never had stocks either.

Quote tax code all you want. You still haven't proven you know ***when riled. It is not a matter of exercising the option or not, it is the fact that you received it as part of your wages, which is reported as earned income.

If you don't exercise the option, that is the same as abandonment, and since this is about stock, you are subject to capital loss rules (meaning you can only deduct $3,000 for total losses).

Try again?

By Zerowone 2013-10-03 00:02:27

Strawman fallacy says what?

http://www.irs.gov/pub/irs-pdf/p525.pdf

Option without readily determinable

value.

If the fair market value of the option is

not readily determinable at the time it is granted

to you (even if it is determined later), you do not

have income until you exercise or transfer the

option.

Exercise or transfer of option.

When you exercise a nonstatutory stock option, the amount

to include in your income depends on whether

the option had a readily determinable value.

Option with readily determinable value.

When you exercise a nonstatutory stock option

that had a readily determinable value at the time

the option was granted, you do not have to include any amount in income.

I'm not even trying yet.

Yeah, maybe you should try again... or just stop its getting pathetic. I already pity you.

[+]

サーバ: Asura

Game: FFXI

Posts: 34187

By Asura.Kingnobody 2013-10-03 07:10:32

Oh hey, thanks for showing IRS Publication #525.

You are failing to see in that same publication you used as your source that you have to report income when you receive from granted stock options except when the option does not have a fair market value (i.e. S Corporation stock)

page 18, left column said: If you receive an option to buy or sell stock or other property as payment for your services, you may have income when you receive the option (the grant), when you exercise the option (use it to buy or sell the stock or other property),

or when you sell or otherwise dispose of the option or property acquired through exercise of the option. The timing, type, and amount of income inclusion depend on whether you receive a nonstatutory stock option or a statutory stock option. Your employer can tell you which kind of option you hold.

Nonstatutory Stock Options

If you are granted a nonstatutory stock option, you may have income when you receive the option. The amount of income to include and the time to include it depend on whether the fair market value of the option can be readily determined. The fair market value of an option can be readily determined if it is actively traded on an established market.

(I'll help you out on this: Publicly Traded Companies are...gasp...publicly traded and have a FMV on all stock options!!!)

Option with readily determinable value

If you receive a nonstatutory stock option that has a readily determinable fair market value at the time it is granted to you, the option is treated like other property received as compensation.

(I'll help you out more on this: Compensation is reported on the W-2...gasp again!)

Guess what type of stock options CEOs receive in lieu of wages?

Non-statutory stock options with a readily determined value!

Guess how it is reported?

Line 7 on Form 1040, not on Schedule D!

But thanks for showing everyone you do not understand both compensation structure and non-statutory stock options.

I can't wait for you to say that CEOs have statutory stock options!

サーバ: Asura

Game: FFXI

Posts: 34187

By Asura.Kingnobody 2013-10-03 07:37:16

Oh, and before you start accusing CEOs from non-publicly traded companies for fraud, consider this:

The only information you have about executive compensation are from the annual statements of publicly traded companies as they are the only ones by law to report executive compensation to the public.

And if you truly believe that all of these CEOs are committing fraud, why not report it to IRS (after they get back to work due to the shutdown) a whole list of CEOs you believe are committing fraud.

I'm sure that they all haven't been audited this year.

By Zerowone 2013-10-03 09:19:47

Good Morning Mr. T-Rex.

Option without readily determinable

value.

If the fair market value of the option is

not readily determinable at the time it is granted

to you (even if it is determined later), you do not

have income until you exercise or transfer the

option. You are failing to see in that same publication you used as your source that you have to report income when you receive from granted stock options except when the option does not have a fair market value (i.e. S Corporation stock) , but with more words. There's a vernacular phrase for that I believe it's "Same Difference".

Option with readily determinable value.

When you exercise a nonstatutory stock option

that had a readily determinable value at the time

the option was granted, you do not have to include any amount in income.

I'm not even trying yet. Guess what type of stock options CEOs receive in lieu of wages?

Non-statutory stock options with a readily determined value!

Guess how it is reported?

Line 7 on Form 1040, not on Schedule D!

But thanks for showing everyone you do not understand both compensation structure and non-statutory stock options.

I can't wait for you to say that CEOs have statutory stock options!

Form 1040 line 7 is tips, wages salaries (income), Line 13 is Capital Gains and you also attach Form 1040 schedule D here look:

Please see line 7 and 13

So if you are saying that you as tax man advises CEO's to report their exercising on non statutory stocks on line 7. That is indeed stupid and fraudulent. You also don't seem to understand the difference between W2's and Form 1040's with this angle you are working.

PS: You started with this:

Oh, and before you say that they don't receive a W-2 from receiving stock options, restricted stock, or any other non-monetary forms of compensation, you better understand that they are required to report such transactions on W-2, in box 12, as code V. Which means that that compensation is subject to both social security and Medicare taxes. Which they would have to report on line 60 as "other taxes" and pay them then (which, if not calculated correctly on or before April 15th, and paid on that same day, those taxes are subject to interest and penalties....GASP!).

To which I said:

And then you just said this:

Guess what type of stock options CEOs receive in lieu of wages?

Non-statutory stock options with a readily determined value!

Guess how it is reported?

Line 7 on Form 1040, not on Schedule D!

But thanks for showing everyone you do not understand both compensation structure and non-statutory stock options.

Now all that being said, please see the comic strip at the top of this post.

Good Day.

Siren.Mosin Siren.Mosin

By Siren.Mosin 2013-10-03 09:28:57

I'm having a hard time believing it, but you two are taking the fun out of mocking poor people.

サーバ: Asura

Game: FFXI

Posts: 34187

By Asura.Kingnobody 2013-10-03 09:53:30

Option without readily determinable

value.

If the fair market value of the option is

not readily determinable at the time it is granted

to you (even if it is determined later), you do not

have income until you exercise or transfer the

option. You are failing to see in that same publication you used as your source that you have to report income when you receive from granted stock options except when the option does not have a fair market value (i.e. S Corporation stock) , but with more words. There's a vernacular phrase for that I believe it's "Same Difference".

Your whole argument is that stock options are not reported as wages for compensation. I showed to you that stock options are reported as wages except the one exception which you based your entire argument on. You were looking at one narrow part of the picture where I was showing you the picture in whole, and also pointing out that your exception was the only exception for reporting income other than ordinary income.

You probably found IRS Publication 525 and thought you had your argument. You failed to actually read and/or understand what the publication really said. I was pointing that out to your limited mind.

Option with readily determinable value.

When you exercise a nonstatutory stock option

that had a readily determinable value at the time

the option was granted, you do not have to include any amount in income.

I'm not even trying yet. Guess what type of stock options CEOs receive in lieu of wages?

Non-statutory stock options with a readily determined value!

Guess how it is reported?

Line 7 on Form 1040, not on Schedule D!

But thanks for showing everyone you do not understand both compensation structure and non-statutory stock options.

I can't wait for you to say that CEOs have statutory stock options!

Form 1040 line 7 is tips, Line 13 is Capital Gains and you also attach Form 1040 schedule D here look:

Please see line 7 and 13

So if you are saying that you as tax man advises CEO's to report their exercising on non statutory stocks on line 7. That is indeed stupid and fraudulent. You also don't seem to understand the difference between W2's and Form 1040's with this angle you are working.

Again, you fail to grasp that we are talking about two different time periods here

"Received options" means that you received the option to exercise the option. What that is is that you have been granted the option to buy stock at a set price. Because that option to buy stock at a set price can be easily determined on a stock exchange, that option has value and therefore income, which is reported as wages by the same publication you claimed says you do not report it as income.

"Excising options" means that you are using said option to purchase stock at a set price, and it is not income because you have already received income based on receiving the stock option as wages. Basically, if you just purchased an item, is that income to you? Didn't think so.

When you sell the stock you purchased from the options you received as wages, the basis of the stock is not the market value of the stock at the time you purchased, but the value of the options you received and reported as income.

Also, Line 7 is not just for tips. Just letting you know that (again) you skipped over words you didn't like to try to prove a point.

Quote: PS: You started with this:

Oh, and before you say that they don't receive a W-2 from receiving stock options, restricted stock, or any other non-monetary forms of compensation, you better understand that they are required to report such transactions on W-2, in box 12, as code V. Which means that that compensation is subject to both social security and Medicare taxes. Which they would have to report on line 60 as "other taxes" and pay them then (which, if not calculated correctly on or before April 15th, and paid on that same day, those taxes are subject to interest and penalties....GASP!).

To which I said:

And then you just said this:

Guess what type of stock options CEOs receive in lieu of wages?

Non-statutory stock options with a readily determined value!

Guess how it is reported?

Line 7 on Form 1040, not on Schedule D!

But thanks for showing everyone you do not understand both compensation structure and non-statutory stock options.

Now all that being said, please see the comic strip at the top of this post.

Good Day.

Seriously, do you not read and/or understand anything? Even your own sources?

I'm having a hard time believing it, but you two are taking the fun out of mocking poor people. There is never any fun in mocking poor people. I fully believe that we can support those who are unfortunate in their lives by encouraging them to change their situation, not in giving them a free ride in life.

By Zerowone 2013-10-03 09:56:50

You obviously didn't read the comic.

[+]

Siren.Mosin Siren.Mosin

By Siren.Mosin 2013-10-03 09:57:24

There is never any fun in mocking poor people

then you sir, need more joy in your life.

what isn't funny about a trailer park?

[+]

サーバ: Asura

Game: FFXI

Posts: 34187

By Asura.Kingnobody 2013-10-03 10:04:37

You obviously didn't read the comic. Well, I could have taken the troll bait, but I can see that for what it is.

There is never any fun in mocking poor people

then you sir, need more joy in your life. You know, that is what my parents/sister/fiance/co-workers/bosses keep telling me...

サーバ: Asura

Game: FFXI

Posts: 34187

By Asura.Kingnobody 2013-10-03 10:06:16

What I don't get is why people are agreeing with Zero when he is obviously wrong and trolling everyone here?

Siren.Mosin Siren.Mosin

By Siren.Mosin 2013-10-03 10:11:16

You know, that is what my parents/sister/fiance/co-workers/bosses keep telling me...

might want to heed thier words, if not mine.

all work & no play makes jack a dull boy.

[+]

VIP

サーバ: Odin

Game: FFXI

Posts: 9534

By Odin.Jassik 2013-10-03 10:14:26

What I don't get is why people are agreeing with Zero when he is obviously wrong and trolling everyone here?

let's be honest, the only thing that's clear is that you are trying way to hard to prove your credentials to a bunch of strangers who don't care, and you are making yourself look like an *** in the process.

[+]

サーバ: Asura

Game: FFXI

Posts: 34187

By Asura.Kingnobody 2013-10-03 10:14:56

You know, that is what my parents/sister/fiance/co-workers/bosses keep telling me...

might want to heed thier words, if not mine.

all work & no play makes jack a dull boy. Unfortunately, I neither have the time nor the ability to enjoy life. Not at the moment.

I rather work hard and reap the rewards now, and retire early and enjoy life earlier than most can.

Caitsith.Zahrah Caitsith.Zahrah

By Caitsith.Zahrah 2013-10-03 10:14:57

There is never any fun in mocking poor people

then you sir, need more joy in your life.

what isn't funny about a trailer park?

Septic tanks? IDK.

[+]

サーバ: Asura

Game: FFXI

Posts: 34187

By Asura.Kingnobody 2013-10-03 10:17:03

What I don't get is why people are agreeing with Zero when he is obviously wrong and trolling everyone here?

let's be honest, the only thing that's clear is that you are trying way to hard to prove your credentials to a bunch of strangers who don't care, and you are making yourself look like an *** in the process. I'm not trying hard at all.

I have not done much research into my counterpoints, and the references I posted as links only took me 15 seconds to get.

As Kara said in other threads, the best information is the correct information. I'm correcting errors made by Zero.

[+]

Siren.Mosin Siren.Mosin

By Siren.Mosin 2013-10-03 10:28:57

Unfortunately, I neither have the time nor the ability to enjoy life. Not at the moment.

jesus christ man, you be damn careful in the mean time. it'd be just like life to hit you with a bus a month before you decide to start enjoying it.

Caitsith.Zahrah Caitsith.Zahrah

By Caitsith.Zahrah 2013-10-03 10:30:46

Unfortunately, I neither have the time nor the ability to enjoy life. Not at the moment.

jesus christ man, you be damn careful in the mean time. it'd be just like life to hit you with a bus a month before you decide to start enjoying it.

Wait until he has kids!

[+]

Siren.Flavin Siren.Flavin

サーバ: Siren

Game: FFXI

Posts: 4155

By Siren.Flavin 2013-10-03 10:31:59

You know, that is what my parents/sister/fiance/co-workers/bosses keep telling me... might want to heed thier words, if not mine. all work & no play makes jack a dull boy. Unfortunately, I neither have the time nor the ability to enjoy life. Not at the moment. I rather work hard and reap the rewards now, and retire early and enjoy life earlier than most can. How are you on FFXIAH boards then? and how did you ever play FFXI? lol... In any case *** that... there's nothing wrong with working hard but wasting years of your life so you can retire at 50 instead of 65 is just imcomprehensible to me... that and you can still work hard and have fun lol...

[+]

Bahamut.Kara Bahamut.Kara

サーバ: Bahamut

Game: FFXI

Posts: 3544

By Bahamut.Kara 2013-10-03 10:32:57

I rather work hard and reap the rewards now, and retire early and enjoy life earlier than most can.

Seriously, if you don't enjoy life, while you are living it, then you might never learn how to.

Not to be too morbid but I've seen too many professionals end up dying before they actually get to "enjoy" the fruits of their labors.

[+]

By Zerowone 2013-10-03 10:34:09

YouTube Video Placeholder

[+]

Siren.Flavin Siren.Flavin

サーバ: Siren

Game: FFXI

Posts: 4155

By Siren.Flavin 2013-10-03 10:37:53

How does one lack the ability to enjoy life? Is that like have a stick forever lodged up your ***?

[+]

Leviathan.Andret Leviathan.Andret

サーバ: Leviathan

Game: FFXI

Posts: 1071

By Leviathan.Andret 2013-10-03 10:40:41

Tax loopholes are pretty complex but there are simple ones that can pretty much work everywhere.

One of the easiest one is simply create a working company and invest most of your income into it. Income tax and company taxes are different as most governments tend to favor tax reduction for small companies to stimulate better economy. Depending on tax laws, most of your investment will be taken out of your income as you don't actually have the 'income' to pay for a high income bracket tax.

You can then transfer some of your expenses to the company. For example, you can buy a car using your company and get it to covers gas and insurance costs. Depending on how you operate your company, you can even move most of your expenses into the company and get them into an accountant. Of course good tax laws will usually try to close this loophole but it can not do so reliably without killing small businesses.

If you are super rich then you can go international. Create an international company, then move yourself out of the country without actually moving and earn your salary from your own company there, deposit them into an off shore account without having such salary in your original country. You will only transfer enough funds for expenses when you need it and you can avoid most of the high income taxes as you don't tell the IRS or such about income you earn outside of the country.

Good tax laws can close this loopholes but doing so will reduce foreign direct investment and will damage the economy if not done carefully.

サーバ: Asura

Game: FFXI

Posts: 34187

By Asura.Kingnobody 2013-10-03 10:41:08

How are you on FFXIAH boards then? and how did you ever play FFXI? lol... In any case *** that... there's nothing wrong with working hard but wasting years of your life so you can retire at 50 instead of 65 is just imcomprehensible to me... that and you can still work hard and have fun lol... I make little breaks here and there to come on this board and post for a few minutes.

Plus, I'm enjoying my life anyway. It may be difficult for you to understand, but I enjoy my job and all of the hard work I put into it.

I just can't take time away from my job much, except when I get off at night. Nor do I take many weekends off because of the nature of my job.

But I do enjoy it.

By Zerowone 2013-10-03 10:42:57

How does one lack the ability to enjoy life? Is that like have a stick forever lodged up your ***?

Its a thing people say to convince themselves against the obvious, against the myriads of books that tell one to not take life, things, and even themselves too seriously. It's termed "Self Deciption" : Here are some great "Self-Deciption" quotes to brighten up your day

[+]

Caitsith.Zahrah Caitsith.Zahrah

By Caitsith.Zahrah 2013-10-03 10:45:35

YouTube Video Placeholder

Ferris Bueller! You deserve so many more pluses than I am able to give!

Quote: California Gov. Jerry Brown (D) on Wednesday signed a bill approving a $2 minimum wage increase to be rolled out over the next three years. Unless another state passes a larger increase, the bump will make California's minimum wage the highest in the country.

The governor joined legislators, business owners and workers at a signing ceremony in Los Angeles on Wednesday morning, with plans to fly to another ceremony in Oakland that afternoon.

“For millions of California’s hardworking minimum wage employees, a few extra dollars a week can make a huge difference to help them provide for their families,” said state Senate President pro tem Darrell Steinberg in a release. "They deserve a modest boost and after six years, an increase in California’s minimum wage is the right thing to do.”

The minimum wage will go up in two separate $1 increments. The first will bump the rate from $8 to $9 in July 2014, and the second increase, to $10, will come in January 2016. According to the Economic Policy Institute, about 3 million Californians are currently working for minimum wage.

Many low-wage workers across the state hailed the news.

Anthony Goytia, who works the overnight shift at a Walmart store in Duarte, currently lives in a garage with his wife and two children, while a third is on the way.

“If I had a higher wage, we would be able to rent an apartment,” he told The Huffington Post. “[Right now] we’re living in poverty. I have to live check to check.”

He detailed the struggles of living off a low wage, especially with a family. “I want to be able to buy my kids shoes if they need them and not wait for our income tax [return] to do it,” he said. “I want to give my wife money for maternity pants and underwear. She needs bras. It’s just ridiculous.”

Goytia said his family cannot afford Walmart’s health insurance plan and must depend on Medi-Cal, the state's Medicare program, instead. They also frequently receive food stamps.

“I really don’t want to depend on food stamps,” he told HuffPost. “I’m a hardworking person; I want to be a proud, working American that’s not on public assistance."

Maria Cristobal works seasonally in a packinghouse or in the lettuce and chile fields near where she lives with her two children in Fresno.

“Two more dollars would impact me a lot,” she told HuffPost. “I would definitely like to have more money for the house, for food, for rent, utilities.”

But she worries that a minimum wage hike might equal a price hike as well.

“When they raise wages, they raise prices of things," she said. "I think companies will cut back on hiring people, and it’s hard to find work sometimes.”

Brown, however, argued the reverse, saying wages in California have stagnated while consumer prices have continued to rise.

“The minimum wage has not kept pace with rising costs,” the governor said in a release. “This legislation is overdue and will help families that are struggling in this harsh economy.”

But by the time the $10 minimum takes effect, it will probably still be outpaced by inflation. According to the Bureau of Labor Statistics, $10 per hour in 2016 is equivalent to roughly $9.36 in today's dollars.

Assembly Speaker John A. Pérez (D-Los Angeles) also disputed the idea that the minimum wage increase would put a drag on the economy.

“A $10 hour minimum wage boosts earnings by $4,000 a year and will put $2.6 billion dollars back into the hands of workers,” he said. “This is money that will be spent at grocery stores, on school supplies and invested in education, and that ultimately strengthens the recovery and ensures California’s job market continues growing faster than the rest of the nation.”

I know many democrats will disagree with me, but this is supporting "unskilled labor" at best. I understand the concept of helping bring a large chunk of working-class Americans out of the poverty bracket but this doesn't really remedy the problem. It's just a temporary fix for a particular demographic, that ultimately will have severe ramifications on the state economy.

The democrats in CA might have civil rights down, but their views on how to fix the economy is bullsh#t. Earlier this year they decided to invest more money into CA prisons rather than K-12 education...

|

|